Minimizing fees: an argument for subnets

Reading Time: 1-2 minutes

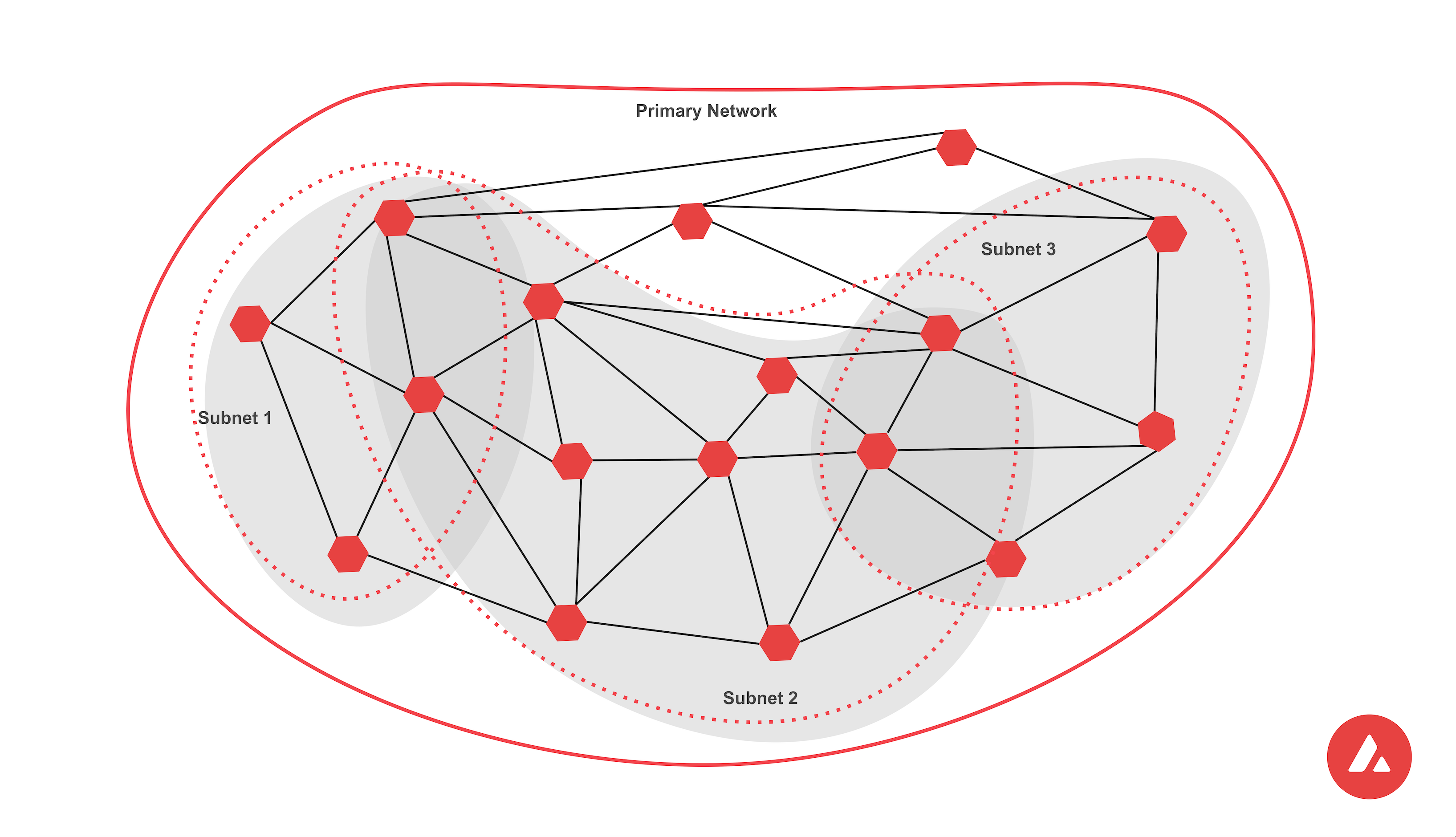

I think Vector Finance (and many other similar apps) should be on their own subnet.

A Dapp is generally a set of smart contract (i.e. it mostly never is a SINGLE smart contract), and smart contracts can interact with each other to perform compounded operations.

An example of compounded operations is Vaults and Strategies Dapps, like Vector Finance , but also SteakHut, YieldYak and others (on Avalanche).

These Dapps generally take your deposits and do a lot of stuff with them, like depositing them to another pool, swapping and/or claiming fees and rewards. And sometimes they do it in a single transactions, to reduce fee overhead.

But even if they batch operations in a single transaction, fees will often be high - meaning higher than 0.10$/tx, that is acceptable even when making multiple transactions per hour.

Some examples:

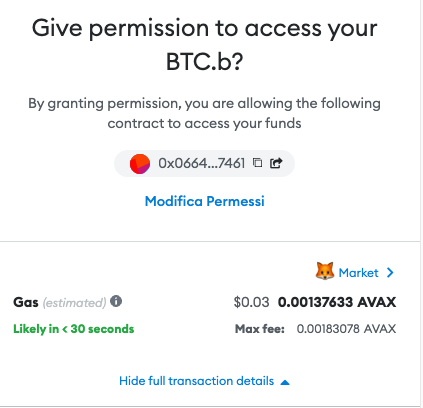

- An approve is one of the simplest, so it just takes 0.03$ of fees in normal conditions (could be close to 0.10$ in rare gas price spikes);

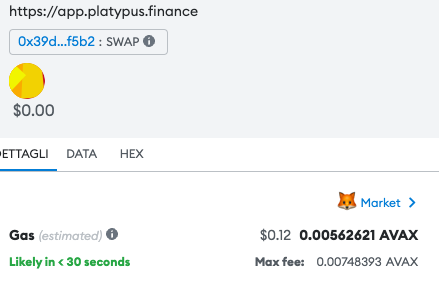

- A swap on a DEX is a bit more complex, and it charges you 0.08 - 0.12, depending on optimizations and type of DEX - a bit higher than my tolerance, but still acceptable

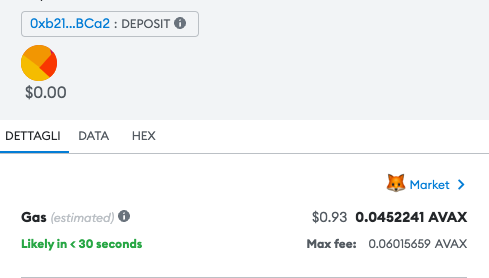

- A deposit in a Vault, instead (like stated above) is really higher, close to 1$ in fees. This is not an Avalanche issue, because gas price is really low. It’s just that there are a lot of operations to be computed for this type of transaction, so there could be a lot of costs.

To reduce fees to (almost) 0 for (almost) every type of transaction, these types of Dapps could move to their own subnet in the near future.

Subnets can leverage the Avalanche Warp Messaging Protocol to make users interact from C-Chain, but execute operations on their own isolated, cheap and traffic-free environment.

Subnets are not only a solution to reduce traffic, but to aggressively minimize fees.

This’ll be a win in UX and a step forward to mainstream adoption.

Dexalot is one that will show us a portion of what I’m talking, after launching on February 1st. Let’s see how it pans out.