Blockchain 101: The Birth of bitcoin

Reading Time: 3-4 minutes

Few will remember 2019 as the year of blockchain: yes, of course, some smartphone manufacturers (HTC, Samsung, for example) announced smartphones with direct support for the new technology.

Google, Mercedes and Ford announced pilot programs for the development of some products and services, but every time some company announces this type of development, it is never clear in detail what type of optimization they are developing.

Surely everyone associates bitcoin and cryptocurrencies with 2017, the year in which bitcoin reached a valuation per single unit of about 20,000 dollars. But 2018 and 2019 were two years of profound changes for the blockchain industry. Projects with advanced technological roots made huge strides forward, and the sector saw a natural selection of the most interesting projects.

To understand how we got to this point, however, it is necessary to take a few steps back and analyze the history of blockchain from the beginning.

Everyone associates bitcoin with Satoshi Nakamoto, a mystical figure similar to the Greek poet Homer: a name that identifies a person, but which could actually represent a movement, a group of people who together conceived the idea behind bitcoin.

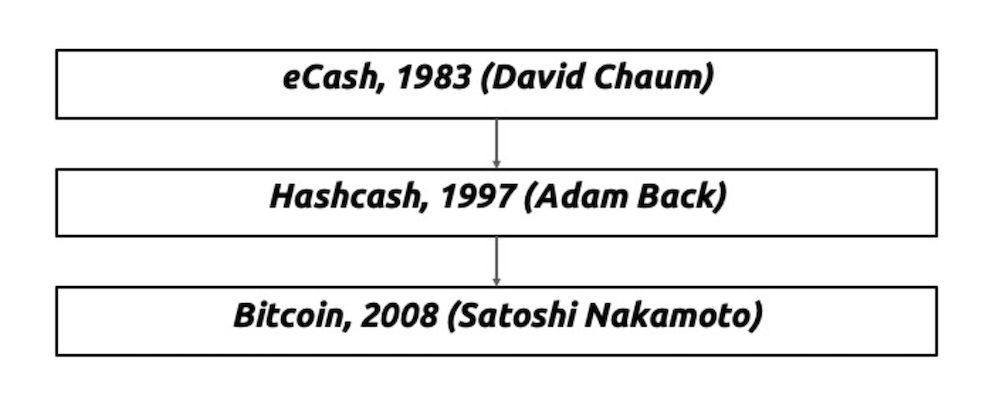

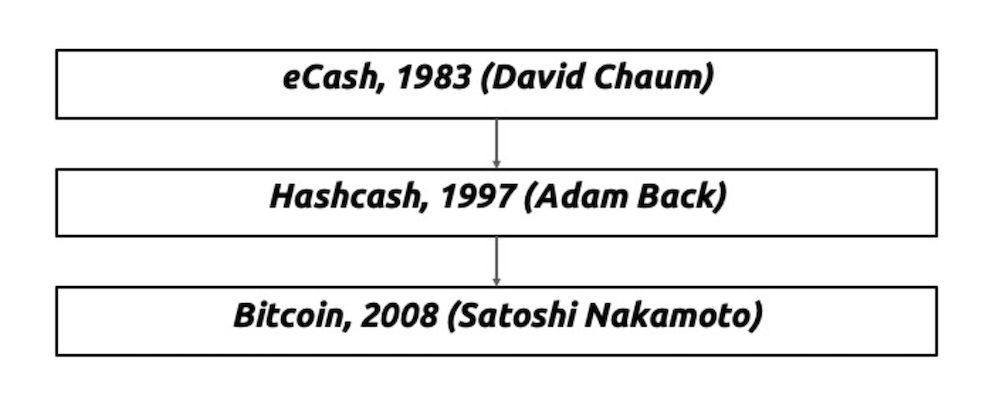

The reality is quite different: like all inventions worthy of respect, bitcoin (and the blockchain, consequently) is also the result of a series of technological inventions, cultural movements and political-social situations that find feedback in the distant 80s, precisely in 1981. In February of that year David Chaum, computer scientist and cryptographer, published a paper, “Untraceable Electronic Mail, Return Addresses, and Digital Pseudonyms”, describing his idea of a network in which users, through pseudonyms, could exchange information and express consent on democratic processes (in the paper the example of application of an election is made), without the need for a universally recognized authority. This paper was followed by another, in 1982 (“Blind signatures for untraceable payments”), which described in detail a digital currency system, capable of reaching consensus between two or more nodes that do not know each other, recording the timestamp of transactions made in a block register. David Chaum had described the blockchain, 25 years before the blockchain as we know it today went online.

The ‘82 paper is considered to be the starting manifesto of the cypherpunk movement on the internet, a movement composed of activists, computer scientists and enthusiasts who put the freedom and privacy of the individual at the center through the use of computer code.

In 1989, Chaum founded DigiCash, the first electronic money company (eCash). Some DigiCash customers, who used electronic money, were Deutsche Bank, Credit Suisse and Bank Austria. In 1999, Digicash declared bankruptcy and sold all its assets to eCash Technologies, another electronic money company that did not have much luck.

But by now the ground had been prepared. In March 1997 Adam Back, also a computer scientist and cryptographer, published a newsletter on the cypherpunks mailing list describing the idea of hashcash: an algorithm that could be integrated with DigiCash and had exactly the piece that Chaum’s currency lacked: a proof-of-work (based on proof of computational work) used to limit spam emails and DDoS attacks. Simply put, the verification of authenticity of the sender was ensured by a task performed by the computer. Today, a very similar system present everywhere on the internet is the Captcha module (“I am not a robot”).

The ‘Day Zero’ of blockchain is to be identified on Friday, October 31, 2008, 2:10 PM. In that precise instant, Satoshi Nakamoto published a message on the cryptography mailing list, describing a project he was working on: an electronic money system that is fully peer-to-peer, without any intermediary. Previously on September 15, 2008, the bankruptcy of Lehmann Brothers was announced, the moment that is historically recognized as the beginning of the financial crisis that led to the greatest global recession since the 20s. Satoshi Nakamoto and the activists of the cypherpunk movement at that time were spokespersons for anarcho-liberal ideas, according to which to restore the individual to financial freedom it was necessary to zero the power of banks and decentralize power into the hands of individuals.

Bitcoin is, in this sense, as well as a technological revolution, also and above all a cultural revolution, which changes the paradigm according to which trust relationships between two or more people must necessarily be controlled and verified by a third intermediary who has specific authority to do so.

And the blockchain, since 2008, has become much more: between internal vicissitudes, new frameworks and alternative solutions, during the series we will discover that the road to the decentralization of the web is tortuous and by no means obvious.